.png?width=300&height=69&name=Logo%20(White%20Only).png)

Wealth Waste Calculator

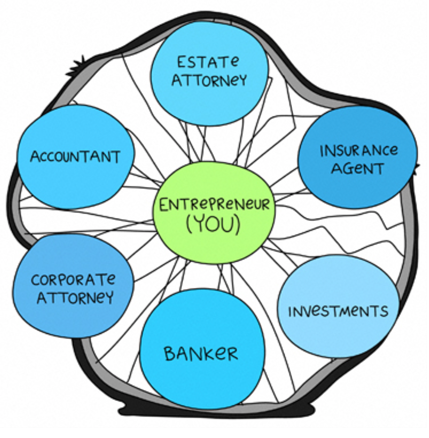

Effective wealth management extends beyond investments. To maximize wealth, Jim Dew explains in this 2-minute video that your "financial wealth wheel" must be appropriately inflated (with the right people in the right roles) and securely interwoven (in close strategic communication).

Neglecting this truth results in a "financial flat tire" that costs our typical customer $150,000 to $1,700,000 annually until we fix it.

Sound hyperbolic? Use our Wealth Waste Calculator™ to estimate how much money you may be leaving on the table without realizing it.

Effective wealth management extends beyond investments. To maximize wealth, Jim Dew explains in this 2-minute video that your "financial wealth wheel" must be appropriately inflated (with the right people in the right roles) and securely interwoven (in close strategic communication).

Neglecting this truth results in a "financial flat tire" that costs our typical customer $150,000 to $1,700,000 annually until we fix it.

Sound hyperbolic? Use our "Wealth Waste Calculator" to estimate how much money you may be leaving on the table without realizing it.

Featured In

When It Comes to Financial Strategy, Entrepreneurs Have Options

When you think of financial planning, you may think it's just about investments. But, especially for successful entrepreneurs, that's just one small piece of a larger puzzle. You're really at the center of a wealth management "wheel." One spoke is occupied by your accountant. Another holds your insurance agent. Yet another is for your estate attorney.

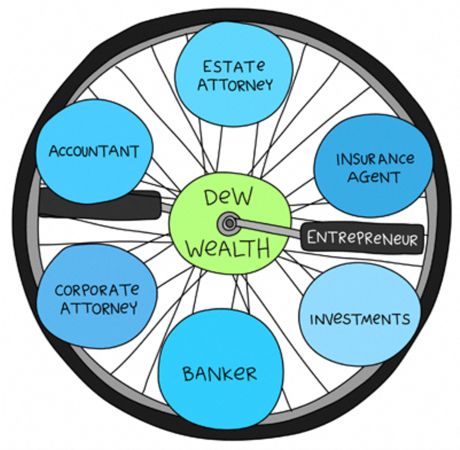

How Do Billionaire Entrepreneurs Do It?

THE ENTREPRENEUR'S

FRACTIONAL FAMILY OFFICE®

We Help Millionaires Think Like Billionaires

By helping you build out a right-sized Fractional Family Office®, you can move away from the middle of the wealth wheel and line up all the "spokes." The reduced "friction" resulting from having all spokes on your wheel tightly lined up could save you tons of money.

And because we have narrowed our focus to work exclusively with U.S.-based business owners who are (1) grossing over $1 million in revenue annually and (2) less than $200 million annually, we're able to take advantage of 20 years of institutional knowledge and systems to develop one of the most targeted and effective models available to support entrepreneurs at this stage in their entrepreneurial journey.

The costs of a Financial Flat Tire are so severe that we save our typical client between $150,000 and $1,700,000 per year, depending on their revenue level, among other considerations, by fixing this "flat tire" for them.

However, statistical averages, while interesting, don’t necessarily tell your story. To see how much money you may be potentially leaving on the table without even realizing it, complete our Wealth Waste Calculator to calculate for yourself just how much money you may, potentially, be leaving on the table right now.

Dew Wealth Success Stories

Unpaid testimonials provided for Dew Wealth Management, LLC.

The Dew Advantage

Proven Track Record

- Dew Wealth has been supporting Entrepreneur’s wealth journeys since 1999.

- We've built over 200 Virtual Family Offices for entrepreneurs making over $1MM per year.

Fiduciary Approach

- We always put your needs ahead of our own. It’s not just a philosophy but our legal responsibility.

- No hidden fees. No referral fees. No questioning whether our advice is in your best interest or ours. Ever. Period.

Specialized Expertise

- Helping Entrepreneurs protect, manage and grow their wealth is all we do. All day. Everyday.

- Our laser-focus on our niche allows us to do what we do at a level of excellence that is second-to-none.